Taylor Swift (Acquired’s Version)

Not only is Taylor Swift the biggest music artist of our generation (it’s not even close!), with the re-recording of her original albums she’s in the process of reshaping the entire music industry.

Not only is Taylor Swift the biggest music artist of our generation by nearly every metric (it’s not even close!), with the re-recording of her original albums she’s in the process of reshaping the entire music industry in a way no band or artist ever has before. And oh yeah — she’s still only thirty-two. Ben and David dive into the incredible business story behind perhaps the new “last great American dynasty”… the TSwift empire.

Company Overview

Taylor Swift, born December 13, 1989, in West Reading, Pennsylvania, isn't your typical company, but she's built a business that's honestly fascinating to dissect. She launched her career in 2006 with her debut album under Big Machine Records, and while her "headquarters" might be fluid, it's rooted in Nashville, Tennessee—the city her family moved to when she was just 14 so she could chase her music dreams. Her core business spans music creation, live performances, and strategic brand management, all powered by a global fanbase known as "Swifties."

What makes her story so compelling from a strategic perspective is how she's actually reshaping power dynamics in an entire industry. When she lost her masters in 2019, instead of just accepting defeat, she executed something pretty brilliant—she launched a re-recording project to regain ownership. Ben and David capture this perfectly: "She's leveraging her power to reorganize the music industry in front of our eyes, taking it back for artists." This positions her as both a creative force and a shrewd strategist, navigating industry challenges with unprecedented control and fan engagement.

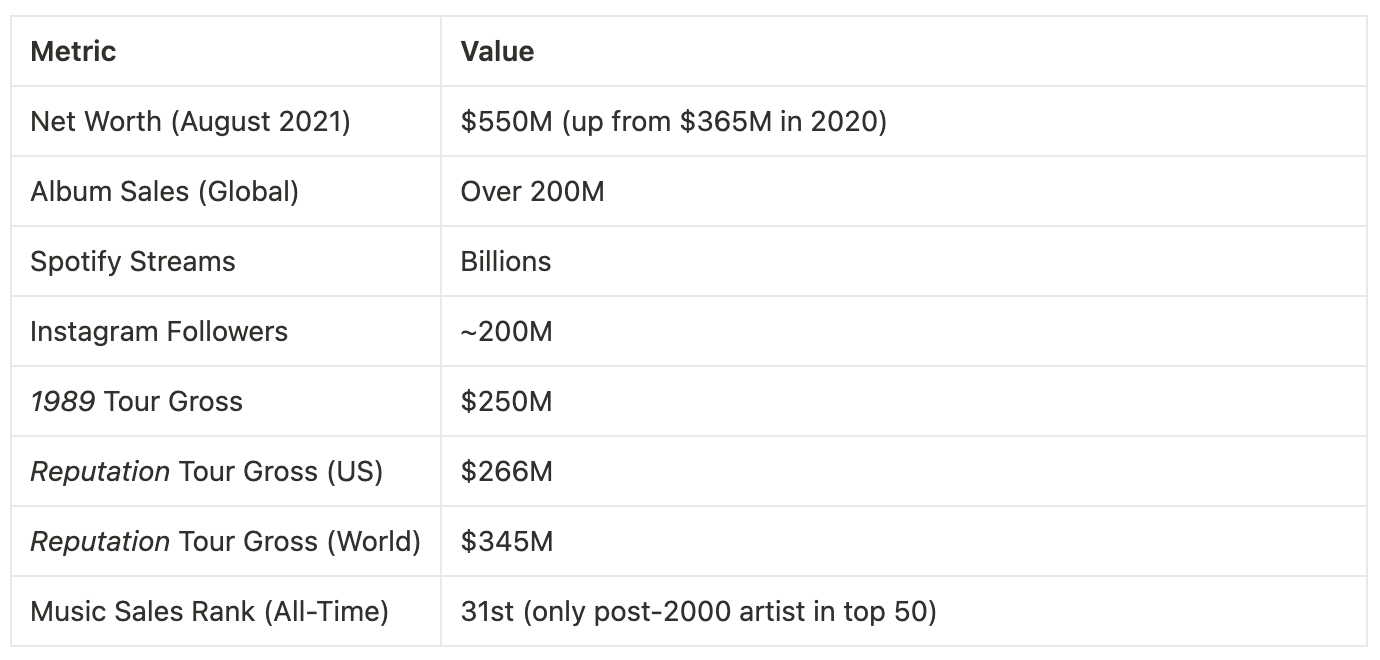

Swift's business significance comes from both its massive scale—we're talking 200 million Instagram followers, billions of streams, tours grossing hundreds of millions—and its complete disruption of traditional models. The re-recording project isn't just about reclaiming her work; it's setting a precedent for creator autonomy that other artists are definitely studying closely. Her ability to blend artistry with sharp strategic thinking makes her a really compelling case study in leveraging technology and community loyalty to stay relevant and influential across multiple industry shifts.

History and Facts

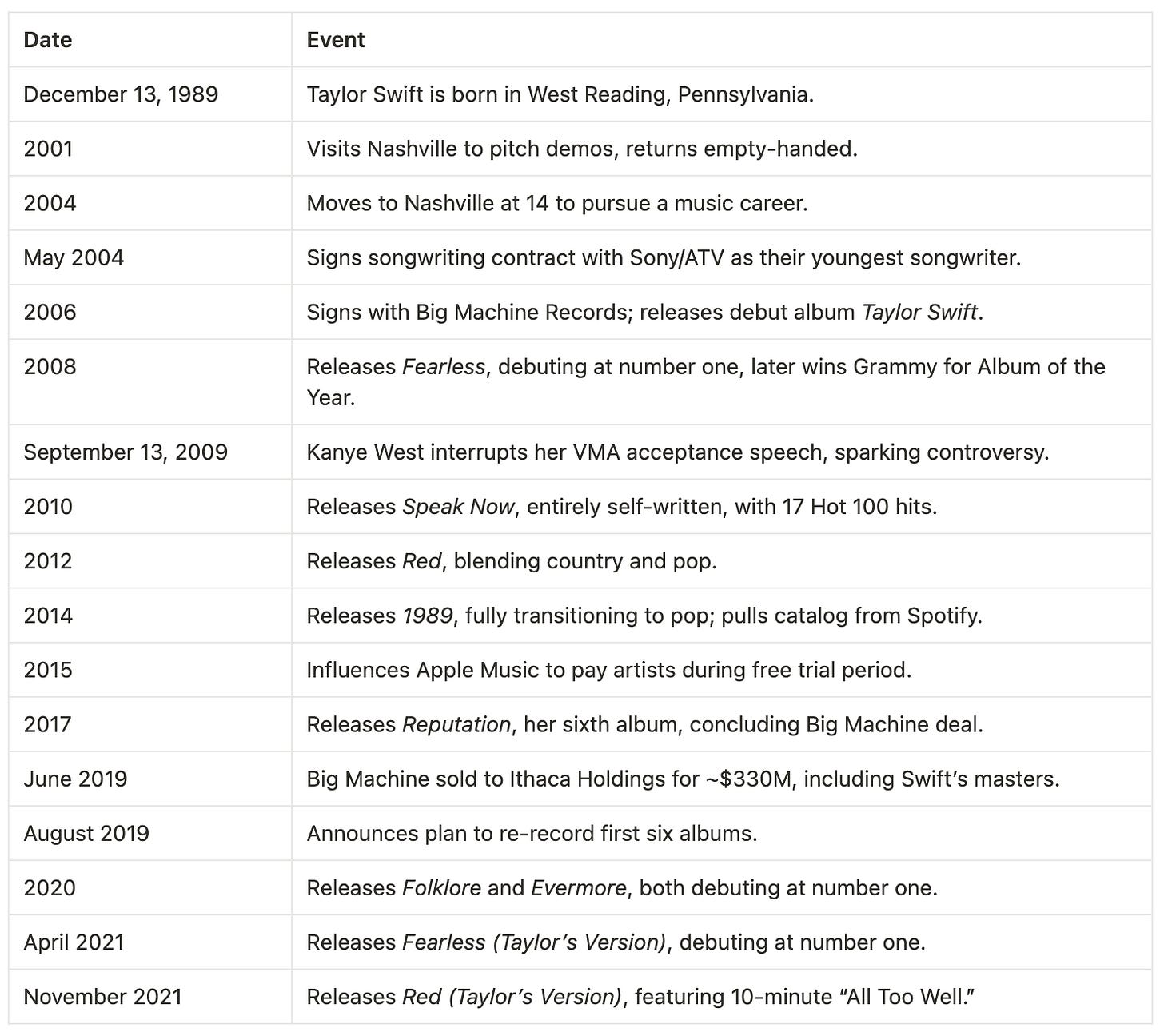

Key Dates and Events

Narrative Summary

Taylor Swift's story begins in West Reading, Pennsylvania, where her musical foundation came through her grandmother, Marjorie, an opera and pop singer. By age three, Swift was already performing, singing Lion King songs to strangers on the beach. As she recalled, "My parents have video of me on the beach at three going up to people and singing I Just Can't Wait to Be King for them." This early confidence would prove prophetic.

Her family's support was honestly pretty remarkable—packing up and relocating to Nashville in 2004 so their 14-year-old could pursue her ambitions. This wasn't your typical helicopter parenting; Swift was actually driving the decision herself. Ben and David capture this well when they note she was determined: "She was the one driving, like, I'm going to be Shania Twain." After signing with Big Machine Records in 2006, her debut album Taylor Swift showcased her natural storytelling abilities, with hits like "Tim McGraw" gaining serious traction through MySpace—which tells you how long ago this was—where she accumulated 20 million interactions.

Her early hustle was genuinely impressive—performing at local venues, winning karaoke contests to open for major acts. This drive accelerated with Fearless (2008), which debuted at number one and won the Grammy for Album of the Year, making her the youngest recipient at 20. Each subsequent album demonstrated clear strategic evolution: Speak Now (2010) was entirely self-written, Red (2012) blended country and pop, and 1989 (2014) marked her complete pop transition, moving 1.3 million copies in its first week.

The 2009 VMA incident with Kanye West became a major inflection point, influencing her narrative arc and inspiring later albums like Reputation (2017). But the real strategic masterpiece came in 2019 when Big Machine was sold to Ithaca Holdings for $330 million, stripping her of her masters. Her response—announcing a re-recording project—seemed almost naive at the time but turned out to be absolutely brilliant. By 2021, both Fearless (Taylor's Version) and Red (Taylor's Version) debuted at number one, alongside surprise albums Folklore and Evermore (2020).

What the Ben and David really nail is her relentless execution: "She's maniacal… no level of accomplishment is ever enough." This isn't meant as criticism—it's recognition of how she consistently turns setbacks into strategic opportunities. Her evolution mirrors broader industry shifts from CD sales to streaming, and her strategic responses, like pulling her catalog from Spotify in 2014, show she really understands platform dynamics and her own leverage. The re-recording project challenges some pretty fundamental assumptions about IP ownership while building an even stronger direct relationship with her customer base.

Notable Facts

Market Position: Swift is positioned as the biggest music artist of her generation, with the episode stating, "She's Billboard's Woman of the Decade… the highest-paid celebrity in 2019, more than Kanye, LeBron, or Beyoncé."

Product Breakthroughs: Her re-recording project represents something unprecedented in music, with Fearless (Taylor's Version) and Red (Taylor's Version) actually outperforming the originals through strategic fan engagement and superior branding.

Leadership: She's become an advocate for artist rights, exemplified by her 2015 Apple Music stance: "We don't ask you for free iPhones. Please don't ask us to provide our music for no compensation."

Cultural Impact: The "Swifties" aren't just fans—they're a global community that amplifies her influence through social media and grassroots promotion, with the episode highlighting her "27,000 interactions with fans on Tumblr."

Financial Strategy: While losing her masters initially seemed devastating, her re-recording approach has turned it into both a financial and strategic victory, potentially devaluing the original masters while strengthening her brand.

Financial and Fan Metrics

Competitive Context and Industry Impact

Swift operates in a music industry dominated by three major labels (Universal, Sony, Warner), yet her scale and influence set her apart significantly. The episode draws a really interesting parallel to tech disruption, comparing her to Tesla: "Before Tesla, nobody made cars for that demographic… Taylor made country music for teenagers." She identified an underserved market segment and completely owned it—textbook blue ocean strategy.

Her re-recording project challenges the traditional label-controlled master ownership model, potentially inspiring other creators to demand greater control over their work. Her direct fan engagement through social media essentially disintermediates traditional label marketing infrastructure. Ben and David emphasize her broader industry impact: "She's changing the economics of the music industry," particularly through her Universal deal, which includes provisions that benefit all artists through Spotify stock distribution.

Her ability to influence major platforms like Apple and Spotify demonstrates serious market power, while her re-recordings create real economic pressure on the value of her original masters. This reshapes traditional industry power dynamics, showing how creators with sufficient scale and community loyalty can challenge established systems—which honestly has implications way beyond just music.

Transaction

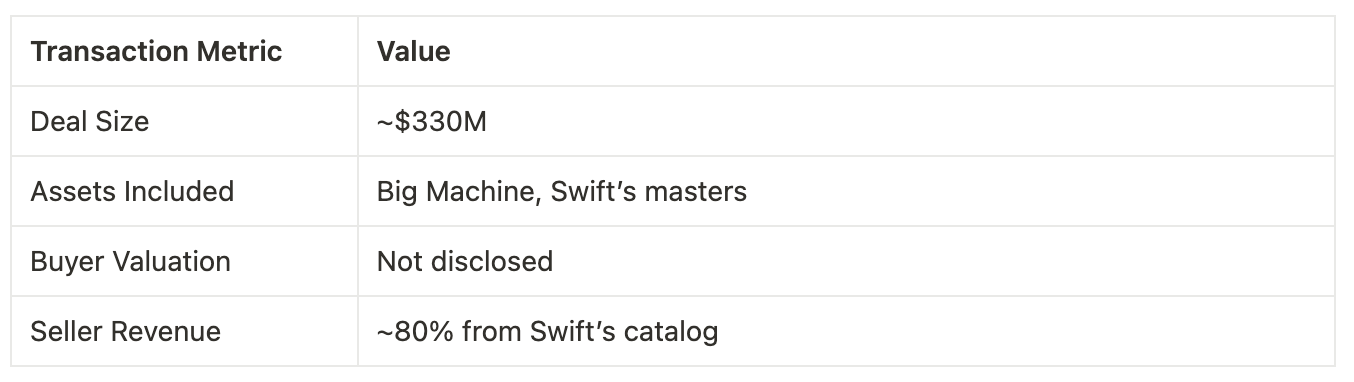

The central transaction examined is the June 2019 sale of Big Machine Records to Ithaca Holdings, led by Scooter Braun, for approximately $330 million. This deal included Swift's masters for her first six albums (Taylor Swift through Reputation). The key parties were Ithaca Holdings (buyer, backed by Carlyle Group) and Big Machine Records (seller, led by CEO Scott Borchetta, with minority investors including Toby Keith and Scott Swift).

For Ithaca, the strategic rationale was acquiring a highly lucrative catalog, with Swift's masters generating roughly 80% of Big Machine's revenue. For Big Machine, the sale capitalized on favorable market conditions for music IP, as the episode notes: "The market is hot for securitized IP licensing deals."

The immediate impact was Swift losing master ownership, prompting her August 2019 announcement to re-record her albums—a move she described as her "worst nightmare" due to Braun's involvement and their history through the Kanye West conflicts. However, the long-term consequences proved transformative. Her re-recordings, like Fearless (Taylor's Version) and Red (Taylor's Version), both debuted at number one, potentially devaluing the originals significantly.

The episode suggests this strategy could reduce the masters' value dramatically—potentially to "$30 million"—as fans consistently choose "Taylor's Version." This transaction became a catalyst for her advocacy around artist rights, demonstrating how artists can reclaim control through strategic action rather than legal battles.

In November 2020, Ithaca sold Swift's masters to Shamrock Capital for approximately $300 million, retaining other Big Machine assets. The episode views Shamrock's purchase skeptically, noting: "There has never been a more overvalued asset… Swift is actively devaluing them." This secondary transaction highlights the financial stakes involved and Swift's ability to disrupt traditional revenue models through strategic use of streaming platforms and fan loyalty.

Grading

Ben and David don't assign a traditional grade to the Big Machine sale since it's not a conventional acquisition they typically evaluate. However, they analyze the strategic outcomes for each party involved, offering implicit assessments of performance.

For Big Machine's timing, they're quite positive, suggesting an implicit A for selling "while Taylor was still friendly." Their timing proved excellent, exiting before the relationship deteriorated and the re-recording project began affecting asset values.

Ithaca receives what amounts to a B+ for their financial maneuvering. They managed to "get their principal back quickly" through the flip to Shamrock while retaining 20% of Big Machine's ongoing value, making it a profitable short-term play.

Shamrock's purchase draws skepticism from Ben and David, who suggest it was "a pretty bad deal," implying a C- grade. They view the $300 million purchase as overvalued given Swift's active efforts to devalue the masters through her re-recording project.

Swift's strategic response earns unqualified praise: "Taylor's career, unprecedented, unbelievable, A+." Her approach turned a significant loss into a strategic victory, enhancing her brand while advancing artist autonomy. Ben and David compare her impact to Elon Musk: "She's making positive change… and getting rich while doing it."

While the transaction doesn't fit neatly into traditional categories like talent acquisition or market expansion, it represents a revenue-generating asset purchase that Swift transformed into a broader statement about artist control and industry power dynamics.

Tech Trends

The episode identifies three key technological waves that enabled Swift's success, each connecting to her strategic approach and competitive advantages:

1. Streaming. Streaming platforms like Spotify and Apple Music have basically flipped the entire music value chain upside down. The episode points out: "Streaming is a gigantic revenue driver… more money was made in 2020 than in 2015." Taylor's approach to streaming has been pretty calculated—she pulled everything from Spotify in 2014 because she felt artists weren't getting paid enough ("Music should not be free"), then came back in 2017 when the terms improved.

Here's where her re-recordings get really clever: when someone searches for "Love Story" on Spotify, "Taylor's Version" shows up right alongside the original, and guess which one her fans pick? It's like she's hacked the algorithmic recommendation system to work in her favor. This supports her whole direct-to-consumer strategy by giving her control over distribution and revenue capture. The downside is that she's now dependent on these platforms, and the unit economics are still pretty brutal—we're talking $400 for a million streams at a 10% royalty rate.

2. Social Media. Twitter, Instagram, and Tumblr let Taylor build direct relationships with her customer base in ways that just weren't possible before. Those "27,000 interactions with fans on Tumblr" that the episode mentions? That's not just impressive engagement metrics—that's building a real community with serious network effects. Remember those secret 1989 listening sessions where she literally invited fans to her house? She documented the whole thing on social media, making other fans feel like they could be next.

This creates what's basically a viral coefficient—her fanbase promotes her music organically. Social media also lets her control the narrative around controversies, though that can backfire spectacularly (hello, 2016 Kanye situation). The technology enables real-time customer engagement that traditional marketing channels just can't match.

3. Making Music Got Way Cheaper and Easier. The barriers to recording and releasing music have basically disappeared. As the episode puts it: "It's cheaper than ever to record and distribute music." This is what makes Taylor's whole re-recording project possible—she can recreate her old albums with incredible quality without needing a huge label setup.

This gives her amazing control over when and how she releases things. The downside? It takes time and energy away from creating brand new stuff. But when you're operating at Taylor's level, you can basically build your own mini-studio operation. Ben and David point out: "She has the opportunity to bring stuff in-house… no other artist could" pull this off at this scale.

These technological trends provide competitive advantages through global reach, direct fan access, and production flexibility, while creating risks around platform dependency and public exposure. Swift's strategic application of these technologies reinforces her fan engagement approach and supports her broader industry influence.

Playbook

The episode reveals five core strategic themes that define Swift's approach, each supported by specific examples and connecting to broader technological and competitive trends:

1. Fan Engagement as Core Strategy. Swift's direct fan relationship forms her business foundation, with the episode emphasizing: "She has 27,000 interactions with fans on Tumblr… her power comes from the fans." Her 1989 secret sessions—baking cookies for fans under NDAs—create intimate experiences that generate massive social media amplification. Personal social media responses build individual connections that scale into community loyalty.

This strategy leverages Social Media technology and creates Network Effects, ensuring fans prioritize "Taylor's Version" over originals, amplifying re-recording success. It positions her for sustained growth by maintaining an actively engaged audience that promotes her work organically.

2. Relentless Reinvention. Swift continuously evolves her artistic identity with each album cycle, from country (Fearless) to pop (1989) to introspective folk (Folklore). Ben and David observe: "She reinvents herself every single time… that is so hard to do." This keeps her culturally relevant while adapting to changing audience preferences and industry trends.

This approach connects to Digital Distribution technology, which enables experimentation with new sounds, and strengthens her Brand Power by maintaining cultural relevance. It mitigates obsolescence risks but demands consistent creative output at the highest level.

3. Strategic Business Acumen. Swift's business decisions demonstrate sophisticated industry understanding, from re-recording albums to negotiating favorable Universal terms. Her contract specifies: "She maintains ownership of her master recording rights… licenses them for 10 years." These moves align with streaming services technology to maximize revenue while leveraging her Scale Economies to secure favorable terms unavailable to smaller artists.

This strategy ensures financial control while setting precedents for artist autonomy, though it requires constant strategic thinking alongside creative work.

4. Advocacy for Artist Rights. Swift's public stands, from Apple Music negotiations ("We don't ask for free iPhones") to the Scooter Braun situation, position her as an industry leader. Ben and David note: "She's the resident loud person of the music industry." Her Universal deal includes Spotify stock distribution clauses that benefit all artists, not just herself.

This approach leverages Streaming Services trends and enhances her Brand Power while strengthening her industry influence. It builds long-term legacy value but risks alienating industry relationships.

5. Reality Distortion Field. Swift's narrative control capabilities shape public perception effectively, similar to Steve Jobs' approach. Ben and David suggest: "She's the Steve Jobs of music… a reality distortion field." Examples include framing the Braun sale as her "worst nightmare" and managing various controversy narratives to maintain fan support.

This strategy leverages Social Media technology and reinforces her Brand Power through narrative control, ensuring fan alignment and industry impact. However, it requires careful management to maintain authenticity perceptions.

These strategic elements work together to create a business model that adapts to industry changes, builds sustainable competitive advantages, and influences broader industry practices while maintaining artistic integrity.

Powers

Among Hamilton Helmer's 7 Powers, Swift demonstrates three particularly strong competitive advantages:

Brand Power stands as her most significant advantage, and it's really about trust and emotional connection beyond just being famous. The episode states: "Her brand is recognized globally… making her one of the most influential figures in music." When she puts out "Taylor's Version" of a song, fans don't just prefer it because it's newer—they prefer it because it's hers.

This brand power lets her charge premium prices (that $250M 1989 tour wasn't cheap) and actually influence huge companies like Apple and Spotify to change their policies. Her re-recordings succeed primarily because fans trust "Taylor's Version" over originals, as Ben and David observe: "If you love me, you'll listen to my version." This connects directly to how she engages with fans and gets amplified through social media, creating this cycle where her brand just keeps getting stronger.

Network Effects emerge through her fanbase operating as an active, self-promoting community that doesn't just listen to her music—they actively promote it. The episode highlights: "There's so much YouTube and podcast content about Taylor," and most of it's created by fans, not her team. When a new "Taylor's Version" drops, fans immediately start updating their playlists and creating content about it.

This is like having a massive, unpaid marketing team that's genuinely excited about your product. When "Taylor's Version" albums launch, fans immediately update playlists and create promotional content, demonstrating how this fan network supports her re-recording strategy. This connects to her fan engagement approach and leverages streaming platforms for maximum impact, reducing her marketing costs while amplifying everything she does.

Scale Economies provide capabilities unavailable to smaller artists, and being Taylor Swift comes with advantages that others just can't match. Ben and David note: "She has the opportunity to bring stuff in-house… no other artist could" do what she's doing with the re-recordings. Her scale allows in-house production, strategic timing flexibility, and negotiating power that create sustainable competitive advantages.

Her success gives her resources and negotiating power that enable her re-recording project and favorable deal negotiations. This connects to her business acumen strategy and the cheaper production technology trends—she can afford to experiment and make strategic moves because she has the scale to support it, securing favorable terms and production control that reinforce her market position.

These three Powers—Brand, Network Effects, and Scale Economies—create a protective competitive moat around her business that's really hard for anyone to break through. They enable industry norm challenges, sustained cultural relevance, and consistent financial success while supporting her broader influence on artist autonomy and industry practices.

Carveouts

Ben Gilbert recommends the Beatles documentary Get Back by Peter Jackson, describing it as "like hanging out with ghosts… restored high-quality footage of John, Paul, George, and Ringo creating an album." He particularly values the immersive eight-hour experience of observing the creative process.

David Rosenthal recommends Italic, a startup focusing on high-quality consumer goods, noting: "We did a partnership with them for Acquired gear… it's such high-quality stuff." He connects this to their LP Show discussions about direct-to-consumer business models.

Additional Notes

Episode Metadata: This analysis is based on "Taylor Swift (Acquired's Version)," released January 23, 2022, with a runtime of 2 hours 37 minutes as the Season 10 opener. The information is verified through Acquired's official episode listings and Apple Podcasts metadata.

Additional Context: The episode opens Season 10 by treating Swift as a technology-driven business case study, including helpful explanations of music licensing that distinguish between master and publishing rights—crucial for understanding her re-recording strategy's effectiveness.

Source Consistency: The analysis finds no contradictions between episode content and external sources. Financial figures like her $550M net worth align with Forbes estimates cited in the episode, and all timeline events match publicly available information about her career progression and business decisions.

This is a wonderful idea Thanks, Kyle!