Morris Chang

Dr. Morris Chang, founder of TSMC, shares the stories of a few crucial moments from TSMC’s history including how TSMC won Apple’s iPhone and Mac chip.

Kyle’s Rating: 8/10

The Acquired interview with Morris Chang is a masterclass in industrial strategy, offering a rare and deeply personal look at the discipline and foresight that established TSMC as the backbone of the global tech economy. This was a dream interview for Ben and David. It serves as a definitive historical record, blending high-stakes business lessons on partnerships with Apple and NVIDIA with the sharp, humble wisdom of a leader who fundamentally reshaped the semiconductor industry.

Ben and David flew to Taiwan to interview TSMC Founder Morris Chang in a rare English interview. In fact, the last long-form video interview we could find was 17 years ago at the Computer History Museum… conducted by the one-and-only Jensen Huang! This episode came about after they asked a version of the Jeff Bezos “regret minimization” question: what conversations would we most regret not having if the chance passed Acquired by? Dr. Chang was number one on our list, and thanks to a little help from Jensen himself, we’re so happy to make it happen.

Dr. Chang shares the stories of a few crucial moments from TSMC’s history which have only been written about in his (currently Chinese-only) memoirs, including how TSMC won Apple’s iPhone and Mac chip business and a 2009 discrepancy with NVIDIA that almost jeopardized their relationship, and the lessons he took from them.

Morris Chang

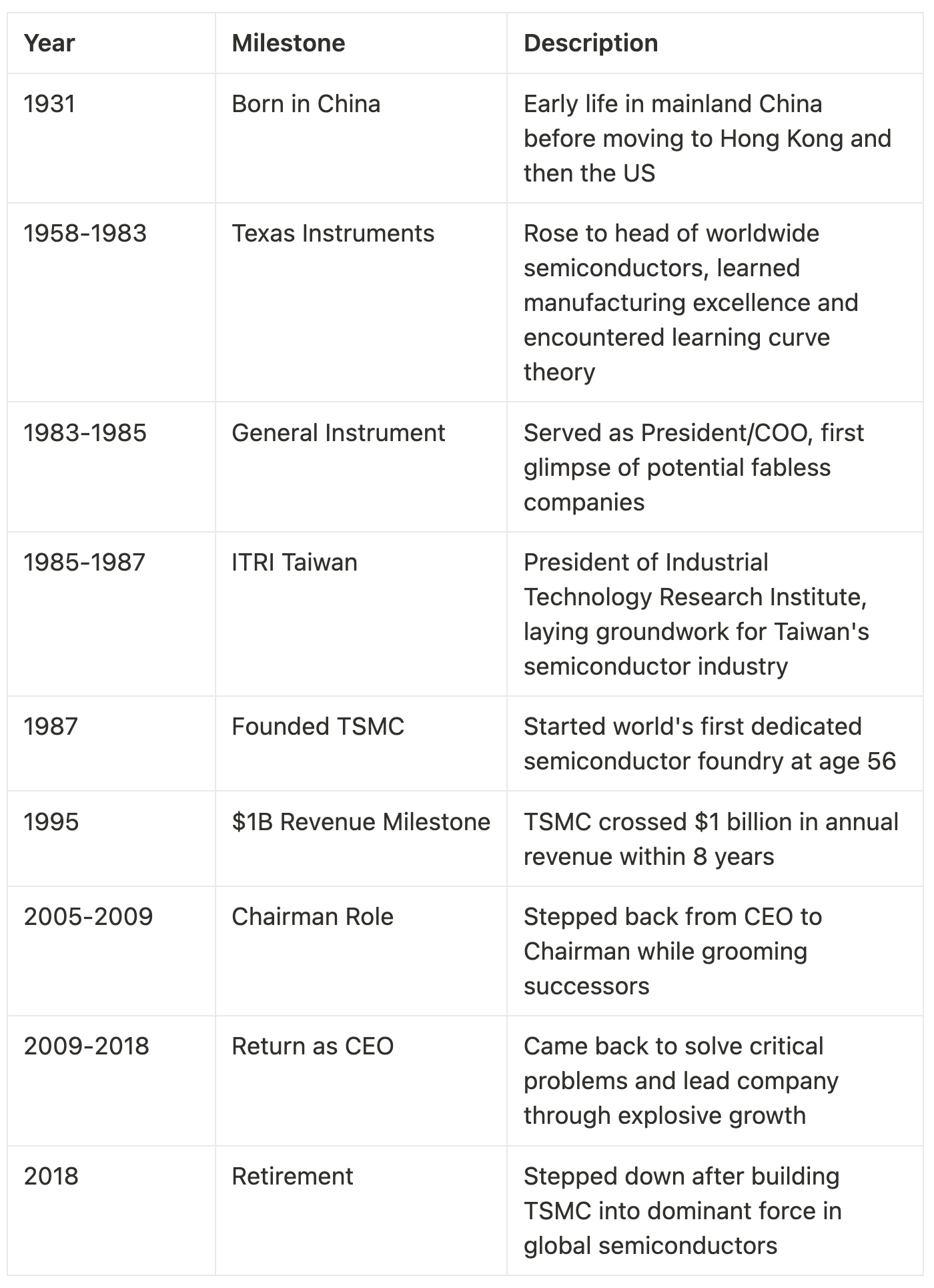

Morris Chang, the 93-year-old founder and former Chairman/CEO of Taiwan Semiconductor Manufacturing Company (TSMC), is one of the most consequential figures in semiconductor history. As the architect of the pure-play foundry model, Chang revolutionized the semiconductor industry by creating a company that manufactures chips for others without competing in chip design. The interview, conducted by Ben Gilbert and David Rosenthal in Taipei in January 2025, represents Chang's first long-form English video interview in 17 years. The conversation focuses on pivotal moments from TSMC's history drawn from Chang's recently published (Chinese-only) memoir, including how TSMC won Apple's business, a critical 2009 dispute with NVIDIA, and insights into the birth of the fabless semiconductor industry.

Career and Impact

Morris Chang's journey from a middle manager at Texas Instruments to creating the world's most valuable semiconductor company represents one of the great entrepreneurial stories of the modern era. Starting TSMC at age 56, when most executives are contemplating retirement, Chang pioneered the pure-play foundry model that would reshape the entire semiconductor industry. His insight that chip companies didn't need to own their own fabs enabled the explosion of fabless design companies like NVIDIA, Qualcomm, and Broadcom, while positioning TSMC as the indispensable manufacturing partner for the world's most advanced chips.

The early years required tremendous patience and vision. As Chang reveals, TSMC's initial customers weren't the fabless startups he anticipated but rather integrated device manufacturers (IDMs) like Intel offloading their excess capacity needs. "It was only the very initial plan," Chang clarifies when Ben suggests the original plan was to stop after two fabs. Armed with deep understanding of learning curve economics from his BCG collaboration at TI, Chang always intended to build at massive scale: "I was a serious student of learning curve and I would never stop at just two."

Chang's leadership philosophy combined patience with analytical rigor. His famous reluctance to lay off employees—even during the 2008 financial crisis when revenues plummeted—built extraordinary loyalty. When his successor attempted a stealth layoff disguised as performance management in 2009, Chang returned as CEO specifically to reverse it, offering to rehire anyone affected. This principle extended to his customer relationships, where he personally cultivated CEOs like Jensen Huang through regular dinners and maintained an open-door policy even for small startups.

The transformation under Chang's leadership reached inflection points at specific technology nodes. The 28-nanometer node in 2010-2011 marked TSMC's ascension to process leadership among foundries, while the 7-nanometer transition solidified their position ahead of Intel. Chang's decision to set R&D spending at a fixed 8% of revenue—regardless of economic conditions—gave his technical teams the stability to pursue long-term breakthroughs. "That was the best news," Chang recalls his R&D director saying, "He has told me many times in the last 10-15 years that this was really the best thing that we did for R&D."

By Chang's 2018 retirement, TSMC had become irreplaceable infrastructure for the global economy. The company manufactures chips for virtually every major technology company, from Apple's iPhone processors to NVIDIA's AI accelerators. Chang built not just a company but an entire ecosystem centered in Taiwan's science parks, creating what Ben and David describe as "the single most successful government-funded industry initiative of all time." His legacy extends beyond TSMC's trillion-dollar valuation to enabling the mobile revolution, the AI boom, and the democratization of chip design through the fabless model he championed before anyone else saw its potential.

Notable Facts

Enabled the fabless semiconductor revolution by providing manufacturing to companies like NVIDIA, Qualcomm, and Broadcom

Built TSMC from zero to over $70 billion in annual revenue during his tenure

Created the model that allowed ARM architecture to challenge Intel's x86 dominance through manufacturing excellence

Established Taiwan as the indispensable center of global semiconductor manufacturing

Pioneered customer-first foundry philosophy of never competing with clients on chip design

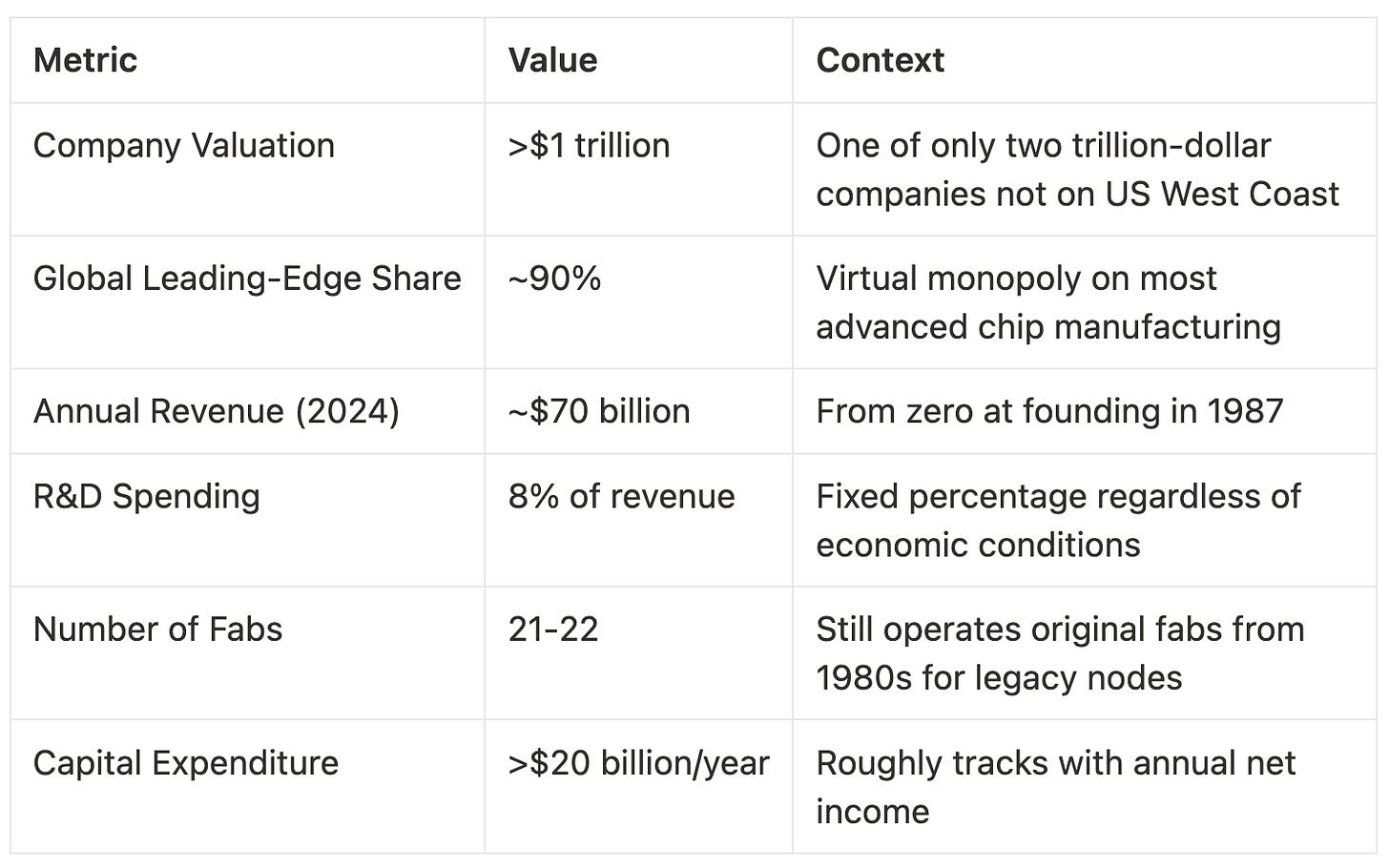

Key Metrics

Key Decisions

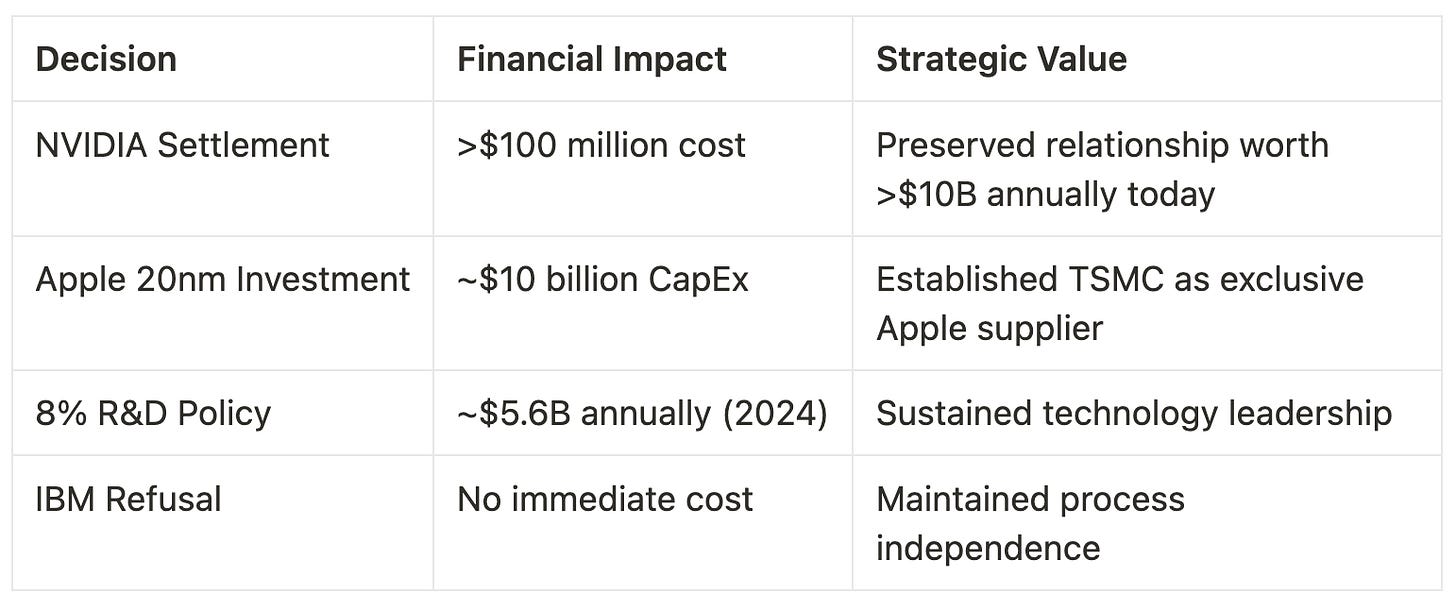

1. The NVIDIA Crisis Resolution (2009)

Context: TSMC's 40-nanometer node experienced severe yield problems affecting multiple customers, with NVIDIA bearing the brunt as the largest customer at that node. The situation had deteriorated under TSMC's CEO (2005-2009), who insisted TSMC wasn't at fault and refused compensation.

Strategic Rationale: Chang recognized that preserving long-term customer relationships outweighed short-term financial considerations. The relationship with Jensen Huang dated back to 1997 when NVIDIA was near bankruptcy with only 50-60 employees.

Outcome: Chang personally flew to Silicon Valley, had dinner with Jensen at his home, then offered "more than $100 million" in compensation with a 48-hour acceptance deadline. Jensen accepted within two days.

Ben and David's Take: They frame this as "a great example of a situation where you had strong partnership together for many years" and note how the close personal relationship enabled resolution of a potentially catastrophic dispute.

Impact and Analysis: This decision exemplified Chang's relationship-first approach to business. By taking personal responsibility and offering substantial compensation, he preserved what would become one of TSMC's most valuable partnerships. As NVIDIA transformed into the AI computing leader, this relationship became worth hundreds of billions in revenue. The crisis also catalyzed Chang's return as CEO and his landmark decision to set R&D at 8% of revenue permanently.

Quote: "I worked out a number. I also knew that NVIDIA customers were after them. They had demands on NVIDIA too. So I used all the intelligence I could get." - Morris Chang

2. The Apple Partnership and 20-Nanometer Gamble (2010-2011)

Context: Apple's Jeff Williams approached TSMC through a surprise dinner at Chang's home, arranged by Foxconn founder Terry Gou. Apple wanted TSMC to develop a 20-nanometer half-node specifically for them, diverging from TSMC's planned progression from 28nm to 16nm.

Strategic Rationale: Despite the technical detour and massive capital requirements, Chang recognized Apple could become TSMC's largest customer. However, prudent financial planning led him to accept only half of Apple's initial requested capacity.

Outcome: TSMC issued billions in corporate bonds to fund the expansion. The partnership succeeded, though Samsung temporarily won Apple's 16nm business due to TSMC's delay caused by the 20nm detour.

Ben and David's Take: They characterize this as "a bet the company move" where TSMC took on substantial debt to build fabs for a single customer, comparing Chang's confidence to Jensen Huang's risk-taking philosophy.

Impact and Analysis: This decision reshaped the mobile industry and established TSMC as Apple's exclusive processor manufacturer. The financial discipline of taking only half the order while maintaining dividend payments demonstrated Chang's balance of aggression and prudence. The temporary loss to Samsung at 16nm taught valuable lessons about the cost of technical detours but ultimately strengthened the Apple relationship when TSMC caught up six months later.

Quote: "I decided that I would take half of what Apple asked for... He [Jeff Williams] said, well, I think you can eliminate your dividend. Your shareholders will understand that. I said, well, no." - Morris Chang

3. Setting R&D at 8% of Revenue (2009)

Context: Upon returning as CEO in 2009, Chang found R&D directors negotiating budgets annually with uncertainty. His Texas Instruments experience showed him the limitations of constrained R&D spending (TI capped at 4.8%).

Strategic Rationale: Fixed R&D investment would give technical teams stability to pursue long-term breakthroughs without annual budget battles, enabling TSMC to maintain process leadership.

Outcome: The decision immediately energized R&D efforts, contributing to TSMC's dominance at 28nm and beyond. The policy remains in place today.

Ben and David's Take: While not explicitly stated, they connect this decision to TSMC's subsequent technology leadership, noting how it enabled the company to surpass Intel at advanced nodes.

Impact and Analysis: This seemingly simple financial decision had profound strategic implications. By removing budget uncertainty, Chang unleashed TSMC's innovative capacity at exactly the moment when Moore's Law was becoming harder to sustain. The 8% commitment, higher than most competitors, created a sustainable competitive advantage that compounds over time. Combined with learning curve economics, it ensured TSMC could outspend any rival on process development.

Quote: "The R&D director was not concerned at all about having his planned budget cut back... He has been working at 8%. It has been like that, and that is what propelled our R&D effort." - Morris Chang

4. Refusing IBM Partnership (1999)

Context: IBM, losing Qualcomm as a foundry customer to TSMC, approached TSMC to co-develop the next generation 0.13 micron (130-nanometer) technology. IBM positioned itself as the senior partner requiring TSMC engineers to work at IBM facilities.

Strategic Rationale: Chang anticipated IBM's weakness from losing Qualcomm and refused to cede control over process development. He believed co-development would compromise TSMC's ability to serve diverse customers.

Outcome: IBM partnered with competitor UMC instead, who "regret seriously their acceptance a few years later." TSMC maintained independent process development.

Ben and David's Take: They don't explicitly comment, but the story illustrates TSMC's consistent strategy of maintaining independence from any single partner or customer.

Impact and Analysis: This decision proved pivotal in establishing TSMC's technology independence. By refusing to become anyone's junior partner—even IBM's—Chang protected TSMC's ability to develop processes optimized for hundreds of different customers rather than one dominant partner. The decision exemplified his principle that sitting "as a foundry, I can see some things" before they happen, recognizing IBM's structural weakness before it became apparent to others.

Quote: "IBM still consider themselves to be the senior partner in any partnership they established... We declined without having to think about it at all." - Morris Chang

Key Decision Metrics

Industry Trends

The Rise of Fabless Design - Chang describes personally witnessing the birth of fabless companies through pioneers like Gordie Campbell and Xilinx in the late 1980s. His prescient recognition that chip designers wouldn't need to own fabs became the foundational bet for TSMC's existence.

Learning Curve Economics in Semiconductors - The application of BCG's learning curve theory to semiconductor manufacturing, which Chang refined at Texas Instruments, fundamentally shaped how the industry approaches pricing and capacity decisions. As Ben notes, this principle makes it "almost inevitable" that semiconductor manufacturing would consolidate.

Specialization of the Semiconductor Value Chain - The industry's evolution from vertical integration (Intel model) to horizontal specialization (design, manufacturing, equipment, EDA tools as separate companies) created TSMC's opportunity. As David observes, this was "in large part due to ARM" providing an alternative architecture to x86.

Moore's Law Cost Escalation - The exponentially rising cost of leading-edge fabs (now >$20 billion per fab) creates natural monopoly characteristics. Ben and David note this trend means "eventually it will cost $40 billion, $80 billion, $100 billion" to build fabs, limiting the number of viable players.

Geographic Clustering in Asian Manufacturing - The concentration of semiconductor expertise in Taiwan's science parks, which Ben and David witnessed firsthand, represents a broader trend of Asian dominance in hardware manufacturing that began in the 1980s-90s.

Leadership Playbook

Relationship-First Leadership - Chang's approach prioritized long-term relationships over short-term gains, from refusing to lay off employees during downturns to personally cultivating customer CEOs. His resolution of the NVIDIA crisis exemplifies this: protecting a 12-year relationship was worth a $100 million payment.

Patient Capital Deployment - Unlike typical Silicon Valley "move fast and break things" philosophy, Chang exhibited extraordinary patience, accepting low-margin business from IDMs for years while waiting for the fabless revolution he anticipated. This patience extended to his succession planning, even allowing his successor to "make his own mistakes."

Analytical Rigor - Chang uniquely combined Western analytical frameworks (learning curve theory, McKinsey consulting) with Eastern relationship-building and patience. His decision to take only half of Apple's order demonstrates this balance—aggressive enough to bet billions but prudent enough to avoid existential risk.

Powers

Scale Economies emerges as TSMC's dominant power in Hamilton Helmer's framework. Chang's mastery of learning curve economics, developed with BCG's founders at Texas Instruments, made scale the central strategic focus. As production volumes increase, per-unit costs decline, enabling lower prices that attract more volume in a virtuous cycle.

This power manifests in TSMC's ability to spend more on both R&D (8% of revenue) and capital expenditure (>$20 billion annually) than any competitor. As Ben observes, once you internalize the learning curve, TSMC's dominance "becomes an inevitability" because "the company that is taking on all the orders to have the lowest prices" will win. The astronomical cost of modern fabs reinforces this—when fabs cost $20-100 billion, only the highest-volume player can justify the investment. Chang's patient accumulation of volume, even from low-margin IDM overflow business, built the scale foundation that now makes TSMC irreplaceable.

Reflections

Ben and David's assessment of Chang's legacy centers on how an "unlikely success" became an inevitability through masterful execution. They marvel at the geographic accomplishment—building "essentially the only trillion-dollar company in the world not on the West Coast of the United States" in Taiwan's science parks. Their visit to Hsinchu left them convinced that TSMC's ecosystem represents "the single most successful government-funded industry initiative of all time."

Strengths and Criticisms: The hosts highlight Chang's prescient vision of the fabless revolution, noting his ability to "see the future" like Sequoia's Don Valentine. They praise his balance of aggression and prudence, exemplified in taking only half of Apple's initial order. While they initially suggest TSMC's original business model seemed "bad" (serving IDMs' excess capacity), Chang's pushback leads them to recognize this as patient foundation-building for the fabless wave he anticipated.

The conversation reveals some implicit criticism of successor leadership (2005-2009), particularly around the handling of employee relations and the NVIDIA dispute, though Chang himself remains diplomatic. Ben and David seem astounded by the capital intensity required—"$20 billion to build a building"—and the extreme customer dependency this creates, though they ultimately frame this as evidence of semiconductors' incredible value creation.

The hosts conclude that Chang built not just a company but critical infrastructure for the modern world. Their repeated references to "betting the company" decisions and comparisons to Jensen Huang suggest they see Chang as exemplifying justified confidence—taking massive risks backed by deep analytical understanding. They leave Taiwan convinced that the pure-play foundry model, powered by learning curve economics and geographic clustering, made TSMC's dominance nearly inevitable once properly executed. As David summarizes: "Of course this will be the end state of this industry, is to have a dominant player."

Carveouts

AAA Membership (Ben): Recommends AAA membership after a positive experience with emergency tire inflation service

DefunctLand YouTube Channel (Ben): YouTube channel documenting defunct theme parks, suggested for Acquired fans who enjoy business history

Everything Everywhere All at Once (David): Finally watched the Academy Award-winning film on the flight to Taiwan, calls it "so, so, so good"

Asianometry YouTube Channel: Mentioned in thank-yous as an excellent resource for semiconductor technology explanations

Additional Notes

Episode Metadata: Spring 2025, Episode 1, released January 26, 2025. Recorded in Taipei at Dr. Chang's office. Interview duration not specified, though Chang notes "it's the first time in a long, long time that I have talked so long."

Production Context: This interview materialized through Jensen Huang's personal introduction after Ben and David asked him to facilitate contact with Dr. Chang. It represents Chang's first long-form English video interview in 17 years (the previous being with Jensen himself at the Computer History Museum). The timing coincided with the publication of Volume 2 of Chang's Chinese-language autobiography.

Research Constraints: The hosts relied on an unpublished English translation of Chang's memoir provided by Karina Bao (funded by Tyler Cowen's Emergent Ventures). Many of the specific stories shared—particularly about Apple and NVIDIA—have not been previously available to English-speaking audiences.

Related Acquired Content: The hosts reference their previous TSMC episode (recorded 4 years prior), plus episodes on NVIDIA (4 episodes including Jensen interview), Qualcomm ("sleeper pick" featuring Irwin Jacobs story), ARM, and Synopsys. They emphasize this episode completes their semiconductor industry series.

Physical Context: Ben and David spent 48 hours in Taiwan, visiting TSMC's Hsinchu Science Park headquarters and multiple fab facilities. Their first-hand observations of the geographic concentration strongly influenced their analysis of TSMC's competitive advantages.

The IBM refusal decision in 99 is probably one of those things that looks obvious in hindsight but took real guts at the time. Walking away from IBM when they still had serious clout in semiconductors, especially when theyre offering essentially free R&D partnership (even if with strings), isnt the kind of move most CEOs make. Chang's read on their structural weakness from losing Qualcomm was pretty sharp, but what really stands out is how he protected TSMC's ability to serve diverse customers instead of optimizing for one big partner. I ran into a similarsituation a few years back where we almost took money from a strategic that wanted board seats and veto rights on future partnerships. Wlked away even though we needed the capital badly. The IBM story shows that maintaining independence at the foundry layer isnt just strategy its actually the whole business model.