The Snap Inc. IPO

SNAP! Acquired is live on the scene reporting from the "Super Bowl" of 2017 tech events: Snap Inc's hugely anticipated IPO. What does the future hold for this plucky "camera company"?

Company Overview

Company Name: Snap Inc.

Year Founded: 2011

Headquarters: Venice, California

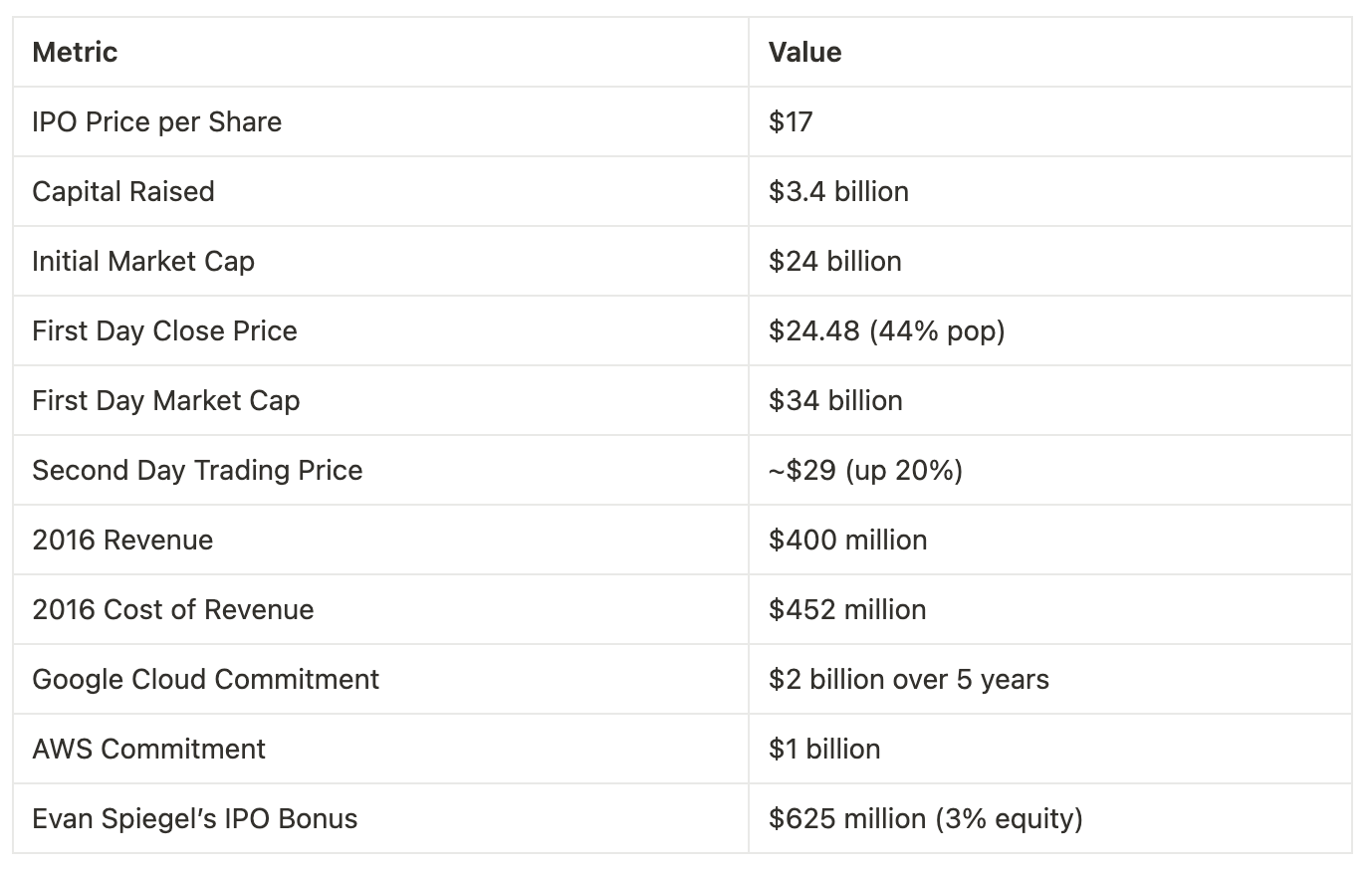

Snap Inc., the parent company of Snapchat, is a technology firm focused on camera-based communication and social media. Founded in 2011 by Evan Spiegel, Bobby Murphy, and Reggie Brown, Snap is headquartered in Venice, California, a hub that reflects its blend of tech and media influences. The company went public on March 1, 2017, with an IPO that priced shares at $17, raising $3.4 billion and valuing Snap at $24 billion initially. The stock surged 44% on the first day, closing at $24.48, resulting in a $34 billion market cap, with a further 20% increase to ~$29 on day two. Snap positions itself as a “camera company,” emphasizing innovative features like Lenses and Spectacles, and targets brand advertising, distinguishing itself from traditional social media platforms. The transcript highlights Snap’s unique approach: “Snapchat gonna be Snapchat. They don’t do things the way everyone else does things.”

History and Facts

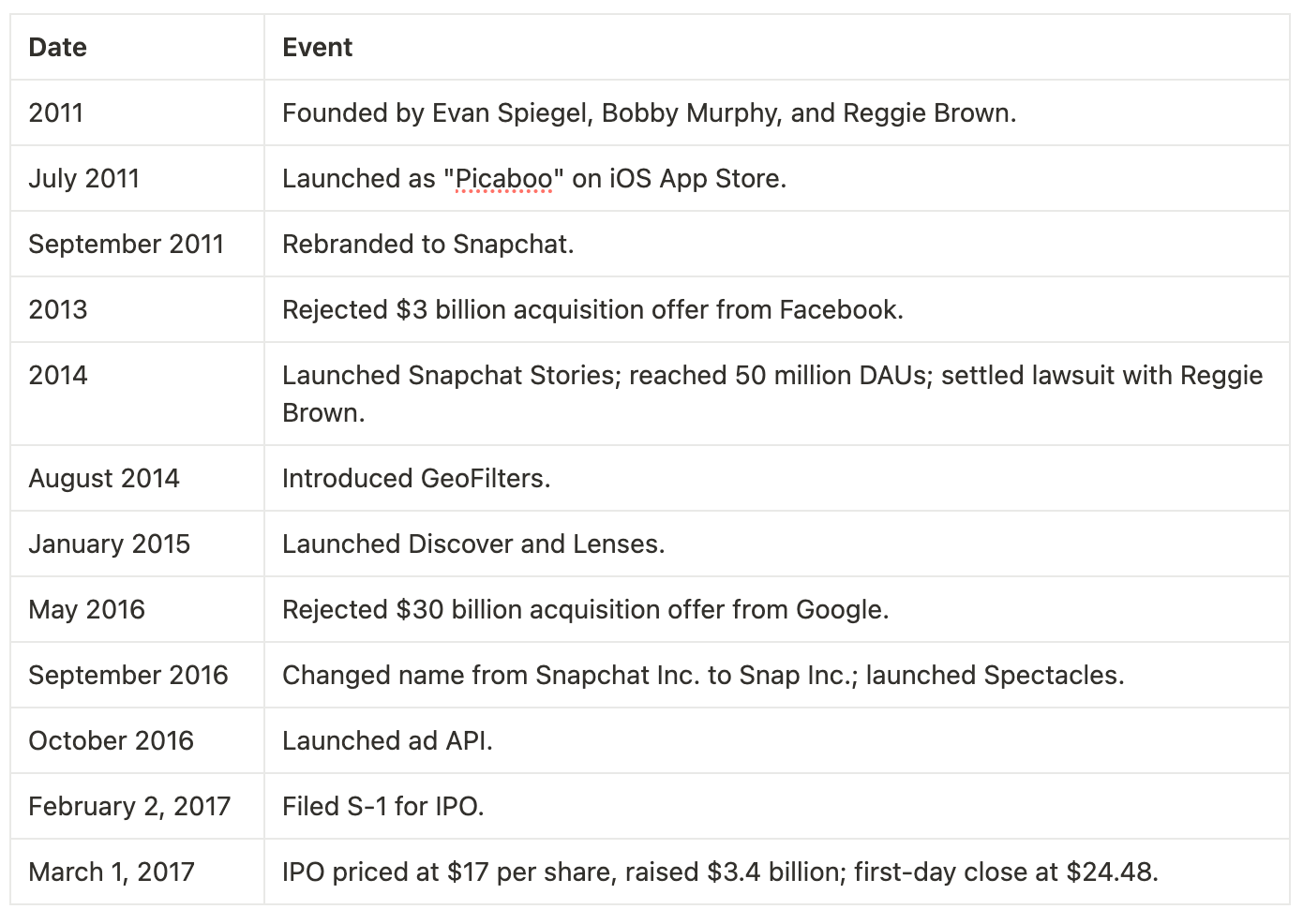

Snap Inc.’s history is a story of rapid innovation, bold strategic decisions, and competitive challenges. Below is a table of key dates, followed by a detailed narrative and notable facts.

Key Dates in Snap Inc.’s History

Narrative

Snap Inc.’s journey began in 2011 when Stanford University students Evan Spiegel, Bobby Murphy, and Reggie Brown launched “Picaboo,” an app allowing users to send photos and videos that disappeared after viewing. Rebranded as Snapchat in September 2011, the app gained traction for its ephemeral messaging, appealing to younger users seeking privacy and spontaneity. The transcript notes the early drama, referencing Acquired’s Episode 12: “We talked about this what-if acquisition where Facebook made a $3 billion… offer to buy Snapchat back in… the end of 2013.” Snap’s rejection of this offer underscored its confidence in an independent path.

By 2014, Snap had achieved significant milestones. The launch of Snapchat Stories, allowing users to compile snaps into 24-hour narratives, boosted engagement, helping the company reach 50 million daily active users (DAUs). That year, Snap settled a lawsuit with Reggie Brown, who claimed he was unfairly ousted, a resolution that received minimal attention during the IPO, as the hosts observed: “Interesting that that has been a total non-narrative in the IPO.” Snap also introduced GeoFilters in August 2014, enabling location-based overlays, further enhancing user creativity.

In 2015, Snap launched Discover, a platform for media content (later Publisher Stories), and Lenses, augmented reality (AR) filters that became a hallmark feature, used by one-third of users daily. These innovations solidified Snap’s reputation as a pioneer in visual communication. The transcript highlights: “They launched Discover, which then became Publisher Stories. They launched Lenses.”

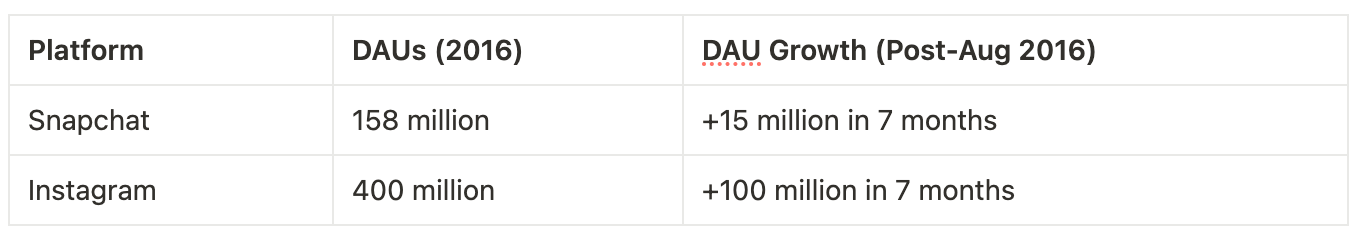

The year 2016 was pivotal. Snap rejected a $30 billion acquisition offer from Google, reinforcing its commitment to independence. In September, the company rebranded from Snapchat Inc. to Snap Inc., reflecting its broader ambitions, including the launch of Spectacles, wearable camera glasses marking its entry into hardware. The transcript notes: “They’re now a hardware company.” In October, Snap launched an ad API, enabling scalable ad purchases, a “huge milestone” that drove revenue from zero in 2014 to $400 million by 2016: “Revenue has grown almost 10x over the past year.” However, user growth slowed after Instagram launched Stories in August 2016, adding 100 million DAUs compared to Snap’s 15 million, a challenge the hosts emphasize: “In that same time, Snapchat has flatlined.”

In 2017, Snap filed its S-1 on February 2, setting the stage for its IPO on March 1. Priced at $17 per share, the IPO raised $3.4 billion, valuing Snap at $24 billion. The stock surged 44% on the first day, closing at $24.48, and rose another 20% to ~$29 on day two, reflecting strong market enthusiasm. The transcript describes this as a “successful IPO,” contrasting it with Facebook’s troubled debut.

Notable Facts:

Market Position: Snap had 158 million DAUs in 2017, strong in the U.S. but lagging globally compared to Instagram (400 million DAUs) and Facebook, as noted: “Snapchat’s got real good saturation in the US. They have very, very little adoption in… other countries.”

Product Breakthroughs: Lenses, used by one-third of users daily, and Spectacles highlight Snap’s AR and hardware innovation, with the transcript stating: “A third of Snapchat users use lenses every day.”

Leadership: Evan Spiegel’s design background from Stanford’s d.school and Bobby Murphy’s technical expertise drive Snap’s vision, as per: “Evan… talked his way into the D school… David Kelly… ended up becoming Evan’s direct advisor.”

Cultural Impact: Snap’s S-1 emphasizes a culture of kindness, with the quote: “When we say kind, we mean the type of kindness that compels you to let someone know that they have something stuck in their teeth, even though it’s a little awkward.”

Financial Challenges: Snap was gross margin negative until recently, with 2016 cost of revenue at $452 million exceeding revenue, largely due to infrastructure costs: “This may actually be the first company to file for an IPO that has a cost of revenue alone higher than revenue.”

Transaction

Snap Inc.’s IPO on March 1, 2017, is the central transaction discussed. It raised $3.4 billion, significantly more than the $1.44 billion raised by 15 U.S. tech IPOs in 2016 combined. Key details include:

Date: March 1, 2017

Parties Involved: Morgan Stanley led the IPO, with Goldman Sachs as a manager. Founders Evan Spiegel and Bobby Murphy retained control through a unique share structure.

Deal Size: Priced at $17 per share, above the $15–$16 range, raising $3.4 billion with an initial market cap of $24 billion.

Market Performance: The stock surged 44% on the first day, closing at $24.48, valuing Snap at $34 billion. It rose another 20% to ~$29 on day two, with nearly 200 million shares traded.

Strategic Rationale: The capital funded innovation in AR and hardware and covered high infrastructure costs ($2 billion to Google Cloud over five years, $1 billion to AWS). The transcript notes: “They had just about a billion dollars in cash on hand and they burned free cashflow of almost, I believe $700 million last year.”

Unique Features:

Share Structure: Public shares have no voting rights, investor shares have one vote, and founders’ shares have ten votes, ensuring perpetual control. The transcript states: “If something happens to one of them, the other gets essentially full voting control in perpetuity.”

CEO Bonus: Evan Spiegel received a 3% equity bonus post-IPO, valued at $625 million, which the hosts found surprising: “I have never seen this before. That’s a weird incentive.”

Market Impact: Despite leaving $1 billion on the table by pricing below the initial trading price, the IPO’s success boosted Snap’s hiring and customer perception: “This all really accrues as value to Snap because in getting this positive momentum, it’s great for hiring.”

The IPO’s success was driven by Snap’s compelling narrative, though challenges like slowed user growth and high costs raised questions about long-term viability.

Grading

Ben and David graded Snap’s IPO execution an “A” for its capital raise and storytelling, introducing a “Narratives” section to analyze the event.

Ben’s Grade: “A on execution… they did it extremely well… with a ridiculous amount of variance.” Ben praised the capital raise and narrative but expressed concern about growth in new markets.

David’s Grade: Agreed with the “A,” comparing it to Facebook’s IPO: “This IPO was brilliantly executed by Snap… versus Facebook’s first two days.” He noted the long-term impact is uncertain.

Snap’s Narrative:

Camera Company: Snap avoids social media comparisons, stating in the S-1: “We are a camera company,” emphasizing Lenses and Spectacles.

Brand Advertising: Targets TV-style advertising, leveraging high engagement (18 daily app opens, 25–30 minutes daily): “They are not going after… the internet advertising to this point has been a reinvention of the classified ad.”

Product Genius: Implies Evan Spiegel and Bobby Murphy are visionary leaders, with the transcript noting: “They don’t refer to him as… a once in a lifetime product genius, but the implication is clearly what they want to imply.”

Media/Investor Narrative:

Growth Problem: User growth slowed, adding only 15 million DAUs post-Instagram Stories, compared to Instagram’s 100 million: “Instagram has added a hundred million daily active users… Snapchat has flatlined.”

Infrastructure Costs: High cloud costs ($2 billion to Google, $1 billion to AWS) led to gross margin negativity: “Their costs are… almost entirely due to infrastructure costs.”

Market Confidence: The 44% first-day pop and 80x sales valuation reflect enthusiasm: “The market has shown over the last two days that they’re willing to give Snapchat a pass.”

Analysis: The “A” reflects Snap’s ability to overcome headwinds (slowed growth, negative margins) through a compelling S-1 and roadshow video. The hosts caution: “The real grade that matters, you know, we’re going to have to come back for at least… round three.” The IPO is not categorized as an acquisition, so acquisition categories are not applicable.

Tech Trends

Ben and David identified technological trends shaping Snap’s strategy, connecting to its playbook and powers:

Camera-Centric Communication: Snap’s focus on cameras as hardware-software-service stacks, with Lenses likened to Apple’s iPhone 7 Plus processing: “That is augmented reality… it requires a lot of processing power.”

Brand Advertising Shift: The move from TV to digital brand advertising, where ad spend lagged engagement until 2017, aligns with Snap’s high engagement: “They argue that that is the same level of engagement that television has historically seen.”

Augmented Reality (AR): Investments in Lenses and Spectacles position Snap for the AR wave, potentially outpacing Facebook’s Oculus: “Is Snap… setting up… for the next wave in tech and putting a stake in the ground that they believe that’s going to be augmented reality?”

Viral Coefficient Challenges: Snap’s communication-focused model limits global network effects: “The product itself lends itself really well to engaging a bunch with a very small set of users which isn’t great for growing into new markets.”

These trends tie to Snap’s playbook by emphasizing innovation and differentiation, critical for competing with social media giants.

Playbook

Snap’s strategic playbook, as articulated by the hosts, includes:

Product Innovation: Features like Lenses, GeoFilters, and Spectacles reflect a culture of experimentation, with internal team competition: “There are two people working in secret… seeing who can better fulfill that vision.”

Camera Company Positioning: Avoids social media comparisons, as Ben notes: “They don’t want to be comped against Twitter… They want you to believe that they’ve done these incredible innovative things.”

Brand Advertising Focus: Targets TV-style advertising, leveraging engagement: “You buy big, broad swaths like you would a television commercial.”

Unique Culture and Storytelling: The S-1’s clarity and kindness ethos, as per: “It’s incredibly compelling, concise, clear writing. And the personality of the company just bleeds through.”

These strategies align with Snap’s tech trends and powers, positioning it for innovation-driven growth.

Powers

While not explicitly referencing Hamilton Helmer’s 7 Powers, Snap’s advantages map to:

Brand: Appeals to teens and preteens, creating a strong identity: “Snapchat’s got real good saturation in the US… It’s in teens, preteens.”

Switching Costs: High engagement (18 daily app opens, 25–30 minutes) fosters loyalty.

Network Effects: Strong in the U.S. but weaker globally: “They have very, very little adoption in… other countries.”

Process Power: Secretive, competitive development drives innovation: “A vision is laid out and there are two people working in secret.”

Primary Power: Brand and process power are most relevant, enabling differentiation and innovation, as the hosts compare Snap to Apple: “All these things are like, we’re the next Apple.”

Carveouts

Ben Gilbert: Recommends the Bill Simmons Podcast, particularly episodes with Ben Thompson and Malcolm Gladwell, for their engaging tech and sports discussions: “It’s so freaking good.”

David Rosenthal: Recommends Sun Tzu’s The Art of War, noting its relevance to Snap’s strategy: “The best victory… is a whole victory where you don’t destroy the other side.”

Additional Notes

Episode Number: 32

Duration: ~1 hour 28 minutes (Apple Podcasts)

Recording Date: March 3, 2017

Release Date: March 4, 2017

S-1 Filing: February 2, 2017, praised as a “watershed moment” for its clarity.

Chris Sacca’s X Post: Highlighted a missed investment opportunity (Sacca’s X Post).

Post-IPO Behavior: Snap executives avoided media, focusing on the LA ecosystem: “They did one interview with the LA Times.”

Future Considerations: The hosts question Snap’s investor base and ability to withstand quarterly scrutiny, speculating on acquisitions like Twitter or media companies.

Table: Key Financial Metrics

Table: User Metrics Comparison