The Uber - Didi Chuxing Merger with Brad Stone, author of The Upstarts & The Everything Store

Brad Stone joins Ben & David to dive deep into the Uber-Didi saga, a wild story with far-reaching implications that still aren't fully appreciated by most of the Western tech community.

Company Overview

Company Name: Uber Technologies, Inc. and Didi Chuxing Technology Co., Ltd.

Year Founded: Uber was founded in 2009; Didi Chuxing was founded in 2012.

Headquarters Location: Uber is headquartered in San Francisco, California, USA; Didi Chuxing is headquartered in Beijing, China.

Uber and Didi Chuxing are ride-sharing platforms that leverage mobile apps to connect drivers with passengers, transforming urban mobility. Uber, a global pioneer, had become a household name in the U.S. by 2012, offering black car services and later UberX, and was aggressively expanding internationally. Didi Chuxing emerged as China’s dominant ride-sharing company, capitalizing on local partnerships and cultural insights to capture its market. The episode, hosted by Ben Gilbert and David Rosenthal with guest Brad Stone, examines the fierce competition between Uber and Didi in China, culminating in a 2016 merger where Uber sold its Chinese operations to Didi. This event highlights the complexities of global expansion, the power of localized strategies, and the strategic necessity of the merger, as Ben Gilbert notes: “The battle for China is settled, but at the end of the day, these are both global companies.” The hosts’ discussion emphasizes the contrasting approaches—Uber’s aggressive global playbook versus Didi’s culturally attuned strategy—and the lessons for tech companies navigating competitive landscapes.

History and Facts

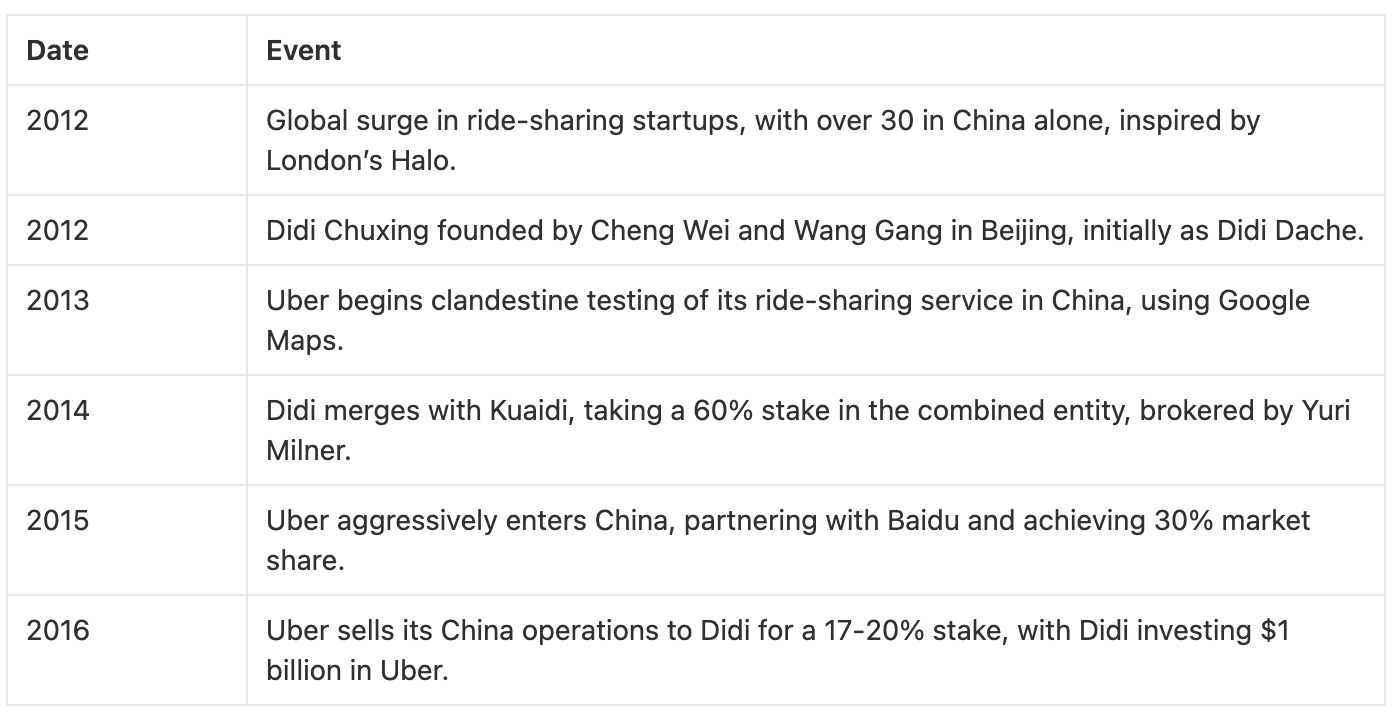

Key Dates and Events

Narrative Summary

The genesis of Didi Chuxing in 2012 reflects the entrepreneurial fervor that swept China during a global ride-sharing boom, sparked not by Uber but by London’s Halo, which announced its U.S. expansion plans. Cheng Wei, a 29-year-old former Alibaba salesman, and his mentor Wang Gang, who invested $100,000 in seed capital, founded Didi Dache after pivoting from a failed app called Momo, a location-based social tool. Cheng’s vision was to harness smartphones to streamline transportation in China, where low car ownership and dense urban populations created a ripe market. As Brad Stone recounts, “Cheng Wei had a vision… that smartphones and technology could make transportation more efficient in China.” Didi’s early integration with Tencent’s WeChat platform, particularly through the Red Envelope feature during Chinese New Year 2014, was a masterstroke, driving explosive user growth. Stone notes, “Didi’s smartest move very early on was to hook into Tencent… everything became possible.” The 2014 merger with rival Kuaidi, facilitated by investor Yuri Milner, gave Didi a 60% stake in the combined entity, consolidating its market position and setting the stage for its showdown with Uber.

Uber, founded in 2009, had redefined urban mobility in the U.S. with its black car service and later UberX, which embraced true ride-sharing after initial resistance. By 2012, Uber was a global force, prompted by Halo’s threat to expand aggressively internationally. In 2013, Uber began clandestine tests in China, with Travis Kalanick personally overseeing driver sign-ups, as Stone describes: “Travis… calls back to headquarters… ‘I need you to tweak the tech so we can run some tests here in China.’” Uber’s full-scale entry in 2015, backed by Baidu’s investment and superior mapping technology, achieved a 30% market share, exploiting Didi’s distraction during its merger with Kuaidi. However, the competition escalated into a brutal war, with both companies raising massive capital—Didi secured $7 billion, Uber $3.5 billion from Saudi Arabia’s public investment fund—to subsidize rides at negative gross margins. Stone vividly captures the intensity: “They start giving this money away to subsidize rides.” By summer 2016, Didi claimed 85% market share, operating in 400 cities compared to Uber’s 100. The unsustainable losses prompted Uber’s investors to push for a truce, leading to the 2016 merger where Uber sold its China operations for a 17-20% stake in Didi, valued at part of Didi’s $35 billion, and Didi invested $1 billion in Uber. This deal allowed Didi to dominate China and Uber to redirect resources to markets like India and autonomous vehicle research, as Stone observes: “It became very clear… this market was about to undergo a major pivot into driverless car technology.”

The episode frames this saga as a case study in global versus local competition, with Didi’s deep integration into China’s tech ecosystem and cultural fabric outmatching Uber’s global playbook. The merger marked a pivotal moment, not only resolving a costly conflict but also highlighting the strategic importance of timing and adaptability in tech markets. The hosts and Stone delve into the personal dynamics—Cheng Wei’s humble yet ruthless leadership versus Travis Kalanick’s aggressive ambition—illustrating how founder DNA shapes corporate trajectories.

Notable Facts

Market Position: By summer 2016, Didi held 85% market share in China, operating in 400 cities, while Uber was in 100, underscoring Didi’s dominance, as Stone notes: “Didi claims… 85% market share.”

Product Breakthroughs: Didi’s integration with WeChat’s Red Envelope feature in 2014 catalyzed user growth, with Stone explaining, “The ride-hailing companies… are ways to spur payment volume with mobile payments.”

Leadership: Cheng Wei’s narrative of personal setbacks, such as failing college exams and selling no insurance policies, shaped his resilient leadership, as Stone recounts: “Cheng Wei presents his story as a series of small personal humiliations.”

Cultural Impact: Didi’s localized approach leveraged China’s cultural pride, contrasting with Uber’s global brand, with Stone noting, “There’s a fierce pride… in the Chinese internet market that they can hold their own.”

Financial Challenges: The competition burned over $10 billion, with both companies operating at negative margins to capture market share, as Stone describes: “They start raising large amounts of money… going deeply, deeply gross margin negative.”

Financial and User Metrics

Competitive Context and Industry Impact

The Chinese ride-sharing market in 2012 was a chaotic battleground, with over 30 startups emerging in response to global trends, particularly Halo’s publicity. Didi’s strategic partnerships with Tencent and Alibaba provided a significant advantage, enabling seamless user acquisition and payment integration. Uber, despite its global dominance, faced challenges in China, including poor integration with Google Maps, which was largely blocked, and a less developed black car market. The 2014 Didi-Kuaidi merger, brokered by Yuri Milner, consolidated the market, reducing the number of competitors and strengthening Didi’s position. Uber’s 2015 entry, leveraging Baidu’s maps and investment, briefly disrupted Didi, but the ensuing war was unsustainable. The 2016 merger reshaped the industry, with Didi emerging as China’s unchallenged leader and Uber redirecting resources to other markets and autonomous vehicle development. Stone highlights the broader impact: “Didi… basically an open playing field to be the primary transportation innovator in the world’s largest transportation market.” The episode underscores the critical role of local partnerships, regulatory navigation, and strategic timing in shaping competitive outcomes, with Didi’s success serving as a model for localized tech strategies.

The broader industry impact extends to the global ride-sharing landscape, where Didi’s investments in Uber’s rivals like Lyft, Ola, and Grab signal ongoing competition. The merger also reflects a shift toward future technologies, as both companies pivot to autonomous vehicles, recognizing that the ride-sharing model may evolve dramatically. The episode’s analysis of competitive dynamics—particularly the interplay of capital, technology, and local knowledge—offers valuable lessons for tech companies navigating global markets.

Transaction

The central transaction is the late 2016 merger where Uber sold its Chinese operations to Didi Chuxing for a 17-20% equity stake, with Didi investing $1 billion in Uber and gaining a board observer seat. The deal valued Didi at approximately $35 billion, reflecting its dominance in China’s ride-sharing market.

Transaction Details

Date: Late 2016 (specific date not provided in the episode, but negotiations concluded within weeks).

Parties Involved: Uber (seller), Didi Chuxing (buyer).

Deal Size: Uber received a 17-20% stake in Didi, valued at part of Didi’s $35 billion; Didi invested $1 billion in Uber.

Valuation: Didi valued at ~$35 billion; Uber’s China operations’ valuation not explicitly stated but implied to be significant given losses of ~$2 billion.

Strategic Rationale: The merger ended a capital-intensive competition that saw over $10 billion raised and burned, allowing Uber to exit a losing market while retaining value through Didi’s stake, and enabling Didi to eliminate its primary competitor and focus on innovation.

Immediate and Long-Term Impacts

Immediate Impact: The merger halted the “scorched earth” competition, where both companies subsidized rides at negative margins, leading to Uber’s $2 billion losses. Uber gained a valuable stake in Didi, estimated at $6 billion, and Didi consolidated its 85% market share, operating in 400 cities. Stone notes, “This is not a bad deal for Uber… nearly 20% of what will be their major international rival.”

Long-Term Impact: Uber’s stake in Didi offers potential for significant returns if Didi expands globally or leverages autonomous technology. Didi secured an unchallenged position in China, as Stone observes: “Didi… basically an open playing field to be the primary transportation innovator in the world’s largest transportation market.” The deal freed both companies to invest in driverless cars, a critical future trend, with Stone noting, “Both Didi and Uber are spending a lot of that money… investigating the future.” However, the global competition persists, as Didi’s investments in Uber’s rivals like Lyft and 99 indicate an ongoing strategic rivalry.

The transaction’s success hinges on the balance between immediate financial recovery and long-term strategic positioning. For Uber, exiting China preserved capital and focus, but the episode questions whether earlier strategic adjustments could have mitigated losses. For Didi, the merger solidified its dominance but required significant dilution, raising questions about the cost of victory.

Grading

The hosts and Brad Stone evaluate the merger’s strategic merits without assigning explicit grades, but their commentary implies assessments. Stone describes the deal as “not a bad deal for Uber,” highlighting the 17-20% stake in Didi, valued at part of Didi’s $35 billion, against Uber’s $2 billion losses, yielding a 2-3x return. He adds, “It was a remarkable retreat… a billion dollars investment to recoup some of the massive losses.” However, Stone questions the necessity of such heavy losses, noting, “If I were a board member… how would I let the situation get to this point?” Ben Gilbert sees it as Uber’s “best option… a highly profitable one,” but critiques its strategic value, stating, “I don’t know that it was that strategically interesting other than a competitive truce.” David Rosenthal assigns a B+ for both sides, citing the deal’s necessity but questioning the sustainability of the companies’ broader strategies: “What are they building here… what is going to be sustainable in 10 years from now?”

Uber’s Grade (Inferred): B+ – A pragmatic retreat that preserved value through a significant stake in Didi, but the episode highlights missteps in underestimating China’s complexities and the distraction from core operations. Gilbert’s comment, “There might have been a lot more interesting things they could have done with that capital,” reflects this critique.

Didi’s Grade (Inferred): A- – A decisive victory that eliminated Uber and solidified Didi’s dominance, but the significant dilution from multiple mergers tempers the triumph. Stone notes, “Both… took enormous amounts of dilution to wage this battle.”

Acquisition Category: The hosts categorize the transaction as “marketplace consolidation,” similar to the Zillow-Trulia merger, but note it’s “incomplete” as global competition continues. Stone likens it to a “peace treaty… Yalta,” emphasizing its geopolitical nature, with Gilbert adding, “An armistice may be signed, but… we will see more Uber and Didi going head to head.”

The grading ties to Uber’s global expansion strategy, which faltered in China due to underestimating local dynamics, and Didi’s localized approach, which leveraged partnerships to secure dominance. The category of marketplace consolidation reflects the strategic intent to reduce competition, but the ongoing global rivalry underscores the deal’s limitations.

Tech Trends

The episode identifies four technological and market trends shaping the ride-sharing industry, each with significant implications for strategy and competition:

Autonomous Vehicles: The shift toward self-driving cars is a defining trend, with both Uber and Didi investing heavily. Stone notes, “It became very clear… this market was about to undergo a major pivot into driverless car technology.” Uber’s testing in Pittsburgh and Didi’s partnerships with Baidu highlight this focus, with Stone adding, “Didi… they’ve got a team and they’ve got some partners.” This trend influences strategy by redirecting capital from subsidies to R&D, connecting to the Playbook’s emphasis on strategic pivots.

Mobile Payments: Didi’s integration with WeChat’s Red Envelope feature during Chinese New Year 2014 drove massive user adoption, as Stone explains, “The ride-hailing companies… are ways to spur payment volume with mobile payments.” This trend underscores the importance of seamless payment ecosystems, giving Didi a competitive edge over Uber, which struggled with integration in China. It links to the Playbook’s focus on partnerships.

Local Market Knowledge: Didi’s success highlights the necessity of understanding local regulations, consumer behaviors, and cultural nuances. Stone observes, “There’s a fierce pride… in the Chinese internet market that they can hold their own.” Uber’s reliance on Google Maps and global strategies faltered, while Didi’s WeChat integration and regulatory navigation prevailed, connecting to the Powers of network effects and brand.

Capital-Intensive Growth: The competition saw over $10 billion raised, with Stone noting, “All sorts of unique sources of capital… were willing to shower all these companies with money.” This trend enabled rapid scaling but raised sustainability concerns, as Rosenthal questions, “If you don’t know what the moat is you’re building… that would make me really scared.” It ties to the Playbook’s lesson on capital as a weapon.

These trends shape competitive advantages and risks. Autonomous vehicles offer long-term efficiency but require massive investment, risking delays or failures. Mobile payments enhance user retention but demand robust integrations, which Uber lacked in China. Local market knowledge is a clear advantage for Didi, but Uber’s global brand faces challenges in replicating this elsewhere. Capital-intensive growth drives scale but risks financial instability, linking to the Powers of scale economies and the Playbook’s strategic retreat lesson.

Playbook

The episode distills five key strategic learnings for tech companies, drawn from the Uber-Didi saga, with detailed connections to other sections:

Global vs. Local Strategies: Uber’s standardized global playbook struggled against Didi’s localized approach, tailored to China’s unique market. Stone notes, “The dynamics of the Chinese market are so unique that Didi’s smartest move… was to hook into Tencent.” This lesson emphasizes the need for cultural and regulatory adaptation, linking to Tech Trends like local market knowledge and Powers like brand. Uber’s failure to adapt cost it market share, while Didi’s WeChat integration drove growth.

Capital as a Weapon: Both companies raised billions to subsidize rides, operating at negative margins to capture market share. Stone describes, “They start giving this money away to subsidize rides.” This tactic drives rapid growth but risks unsustainability, as Rosenthal critiques, “What is going to be sustainable in 10 years from now?” It connects to Tech Trends of capital-intensive growth and Powers of scale economies, highlighting the need for strategic capital allocation.

Strategic Retreats: Uber’s exit from China was a calculated move to preserve value, as Gilbert notes, “It was their best option… a highly profitable one.” The merger allowed Uber to refocus on markets like India and autonomous vehicles, linking to Tech Trends of autonomous vehicles and the Powers of network effects. This lesson underscores the importance of knowing when to pivot, avoiding prolonged losses.

Partnerships and Alliances: Didi’s integration with WeChat was pivotal, with Stone stating, “When they hooked into Tencent… everything became possible.” Partnerships with local tech giants provided competitive edges, contrasting with Uber’s reliance on Baidu, which was less effective. This connects to Tech Trends of mobile payments and Powers of network effects, emphasizing the value of strategic alliances.

Cultural Adaptation and Founder DNA: Didi’s success reflected Cheng Wei’s humble yet ruthless leadership, contrasting with Travis Kalanick’s aggressive style. Stone observes, “Cheng Wei… had a vision… but along with that idealism, there was a ruthlessness.” This lesson highlights how founder DNA shapes strategy and culture, linking to Tech Trends of local market knowledge and Powers of brand. Gilbert notes, “Companies take the shoes of their founders and stay that way kind of forever,” underscoring cultural alignment’s role in market fit.

These playbook themes position companies for success by emphasizing adaptability, strategic timing, and leveraging local strengths. They address future challenges like regulatory shifts, as Stone notes post-merger restrictions on drivers, and technological pivots, reinforcing the need for agility in dynamic markets.

Powers

While Hamilton Helmer’s 7 Powers are not explicitly referenced, the episode implies several relevant powers, with detailed analysis of their application:

Network Effects: Ride-sharing platforms thrive on network effects, where more drivers and riders enhance platform value. Didi’s WeChat integration amplified this, as Stone notes, “WeChat integrates Didi… and they start to take off on steroids.” Uber’s global network was less effective in China, where local integrations drove user retention, linking to Tech Trends of mobile payments and Playbook’s partnership lesson.

Scale Economies: Didi’s dominance in 400 Chinese cities enabled cost efficiencies, with Stone stating, “Didi claims… 85% market share… operating in 400 cities.” This scale reduced per-ride costs, giving Didi a competitive edge over Uber’s 100 cities, connecting to Tech Trends of capital-intensive growth and Playbook’s capital strategy.

Brand: Didi’s localized brand resonated with Chinese users, leveraging cultural pride, as Stone observes, “There’s a fierce pride… in the Chinese internet market that they can hold their own.” Uber’s global brand struggled to adapt, linking to Tech Trends of local market knowledge and Playbook’s cultural adaptation lesson.

Switching Costs: While less prominent, Didi’s WeChat integration created subtle switching costs, as users embedded in the ecosystem were less likely to switch to Uber. This links to Tech Trends of mobile payments and Playbook’s partnership strategy.

The most relevant power is Network Effects, as Didi’s integration with WeChat created a self-reinforcing cycle of user growth, outpacing Uber’s efforts. This power underpins Didi’s competitive moat, reinforced by scale economies and brand, and connects to the Playbook’s emphasis on partnerships and Tech Trends of local market knowledge.

Carveouts

The hosts and Brad Stone share personal recommendations in the episode’s carveout segment:

Ben Gilbert: Why You Should Stop Caring What Other People Think by Tim Urban (Wait But Why), a blog post exploring the evolutionary roots of social approval and advocating for individuality. Gilbert highlights its insight: “It was evolutionarily advantageous for other people to like you… so you’re fighting biology.”

David Rosenthal: Conversations with Tyler, a podcast by Tyler Cowen featuring discussions with figures like Peter Thiel and Kareem Abdul-Jabbar. Rosenthal praises its depth, noting, “It’s a fascinating conversation.”

Brad Stone: Sapiens and Homo Deus by Yuval Noah Harari, books offering a sweeping perspective on humanity’s past and future. Stone describes them as “mesmerizing,” adding, “To step back and look at humanity in an ethical timeframe is why I love his work.”

Additional Notes

Episode Metadata: Episode 31, titled "The Uber - Didi Chuxing Merger with Brad Stone," released on March 1, 2017, with a duration of approximately 1 hour 15 minutes, recorded in mid-February 2017 at KUOW in Seattle.

Related Episodes: The episode references prior discussions on Amazon, Lyft, and the upcoming Snapchat IPO, suggesting listeners explore these for context.

Miscellaneous Insights: The episode highlights the intensity of China’s tech market, with Stone’s anecdote of a Didi engineer hospitalized due to overwork: “One of the engineers had to go to the hospital because his contact lenses had become sealed to his eyeballs.” This underscores the cultural differences in work ethic and competition pace.